us exit tax green card

Noncitizens Who Face the Exit Tax. Only green card holders are taxed.

Sb 1 Returning Resident Visa Guide Herman Legal Group

To put this simply if you held your Green Card for a.

. Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them. Paying exit tax ensures your taxes are settled when you. You are a long-term resident which means you have held a green card in at least 8 of the previous 15 years IRC 877 e 2 877A g 5.

American citizens who give up their citizenship or cease to be green card holders are subject to a series of complex rules called the US Expatriation Tax aka Exit Tax. The Exit Tax Planning rules in the United States are complex. US Exit Tax Giving Up a Green Card.

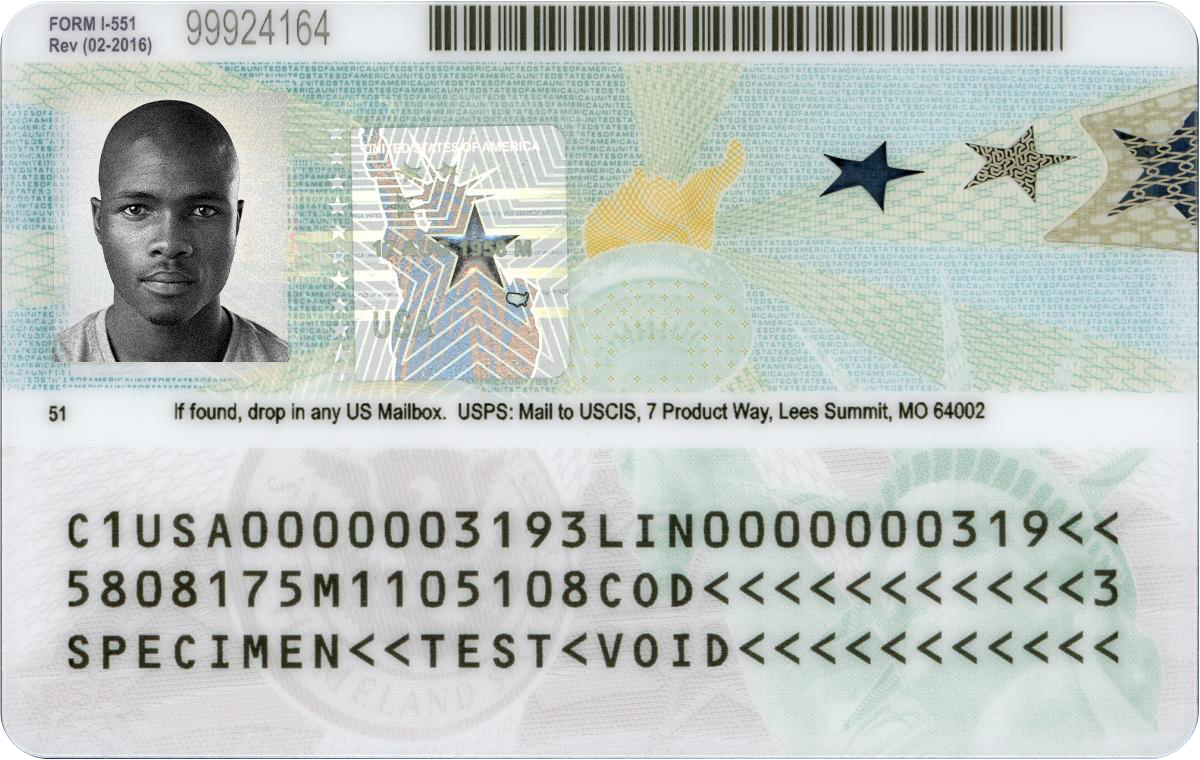

Citizens Green Card Holders may become subject to Exit tax when relinquishing their US. To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used. If you are neither of the two you dont have to worry about the exit tax.

When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective. The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents. No products in the cart.

Giving Up a Green Card US Exit Tax. Not everyone is taxed as they leave. The US has enacted an Exit Tax that prevents US citizens and green card holders from giving up their residency in order to avoid paying US taxes on accumulated wealth.

Generally it takes a few months to hear back. Different rules apply according to. For Green Card holders to be subject to the exit tax they must have been a lawful permanent.

From an immigration perspective it is relatively straightforward the person usually files a Form I-407 by mail and waits for approval. Green card holders are also affected by the exit tax rules. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

Giving Up a Green Card US Exit Tax. It applies to individuals who meet certain thresholds for annual income net worth. This can mean that green card holders who have not.

The expatriation or US exit tax is imposed for a period of ten years after the expatriation process is completed. Someone who is a US. If you make the election to be a nonresident of the United States for income tax purposes you risk triggering the exit tax.

Transfers made while a non-resident non-citizen for estate and gift tax purposes are not subject to US. The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents. Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued failure to pay.

Green Card Holders and the Exit Tax. Citizens or long-term residents. Giving Up a Green Card.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or green card. The expatriation tax rule only applies to US. When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective.

Gary Clueit in conversation with IRSMedic and Expatriationlaw makes it clear that the Sec. The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. For example if you got a green card on 12312011 and.

In this first of our two-part series. The exit tax process measures income tax not yet paid and delivers a final tax bill. Your risk exists if.

The exit tax and the inheritance tax Both may be triggered upon abandonment of citizenship or for non-citizens abandonment of a green card by a long-term resident. A green card holder must have been a lawful permanent resident in eight of the 15 years ending. A long-term resident is defined as a lawful permanent resident in at least 8 of the 15 years period ending with the expatriation year.

For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable years ending with the taxable year during which the expatriation occurs when you give back your green card. The expatriation tax consists of two components. The Exit Tax itself is computed as if you sold all of your worldwide assets on the day.

Taxpayer because of spending too many days in the United States can terminate US. From an immigration perspective it is relatively straightforward the person usually files a Form I-407 by mail and waits for approval. Its critically important to understand that Green Card holders who are long term residents may be subject to the 877A expatriation tax if they surrender their Green Card.

By giving up citizenship they become expatriates under the IRC. Citizenship or long-term residency by non-citizens may trigger US. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

Citizens who have renounced their citizenship and long-term residents as defined in IRC 877 e who have ended their US. Generally it takes a few months to hear back. Resident status for federal tax purposes.

1 786 373 7988. Green card taxes are required for green card holders. Currently net capital gains can be taxed as high as 238 including the net.

Citizens of the United States trigger the exit tax rules when they voluntarily or involuntarily terminate that status. Your risk exists if. You cease to be a lawful permanent.

2801 tax on bequests from covered expatriates WILL affect his estate. Exit tax applies to United States expatriates a term describing people who have renounced their US citizenship and those who have renounced a Green Card that they have held for at least eight years. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Green Card Holders Staying Abroad Over 6 Months Risk Abandonment

3 Steps Green Card Process Explained For Eb1 Eb2 Eb3 Eb5

Renounce U S Here S How Irs Computes Exit Tax

Green Card Exit Tax Abandonment After 8 Years

Exit Tax In The Us Everything You Need To Know If You Re Moving

Renouncing Us Citizenship Expat Tax Professionals

Do Green Card Holders Living In The Uk Have To File Us Taxes

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Exit Strategies For Real Estate Investors Exit Strategy Real Estate Investor Real Estate Investing

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Us Tax Residency Status Explained Resident Or Nonresident

Tax Filing For Green Card Holders Chicago Immigration Law Firm

Irs Tax Rules For Green Card Holders Filing U S Tax Returns

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly